THE BRIEF:

Create the branding and an accompanying campaign to promote the release of a new SaaS product that helps small to medium-sized businesses across the U.S. compliantly trade internationally.

THE THINKING:

Having worked for a year in a tech startup, I know international trade compliance is complicated. I also know that SaaS products can be similarly complex. So, clarity is key when communicating a product’s value.

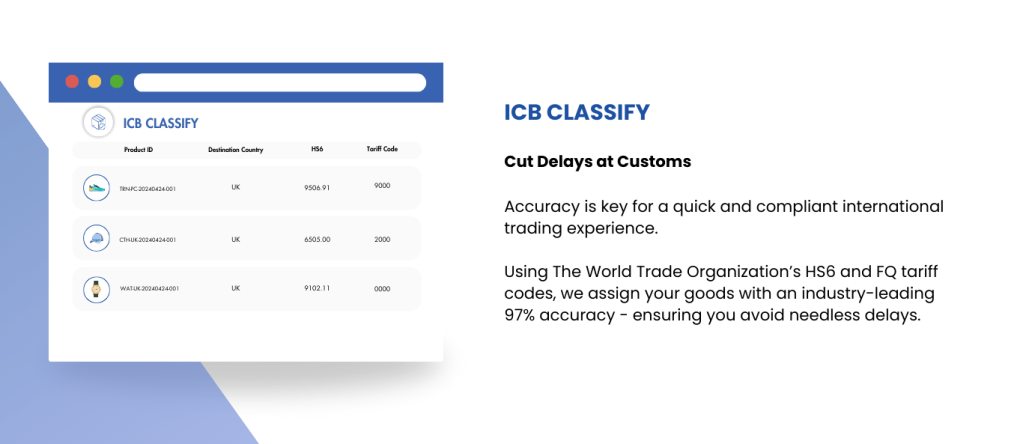

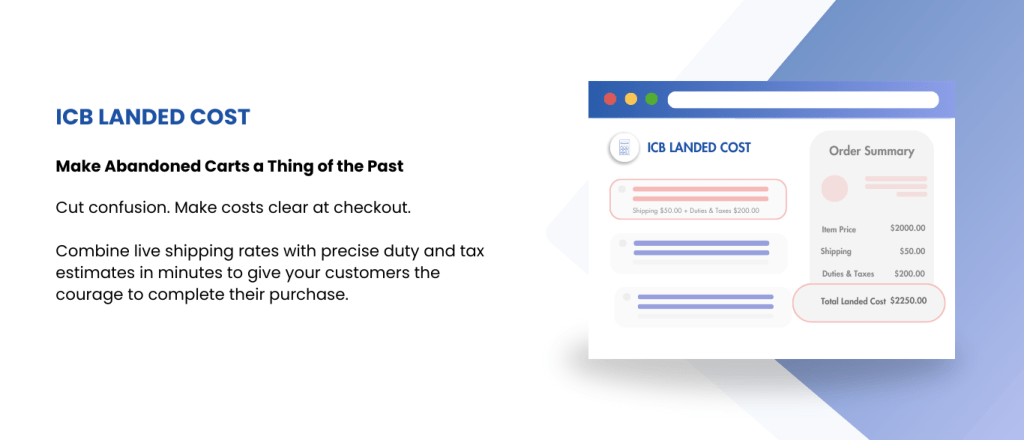

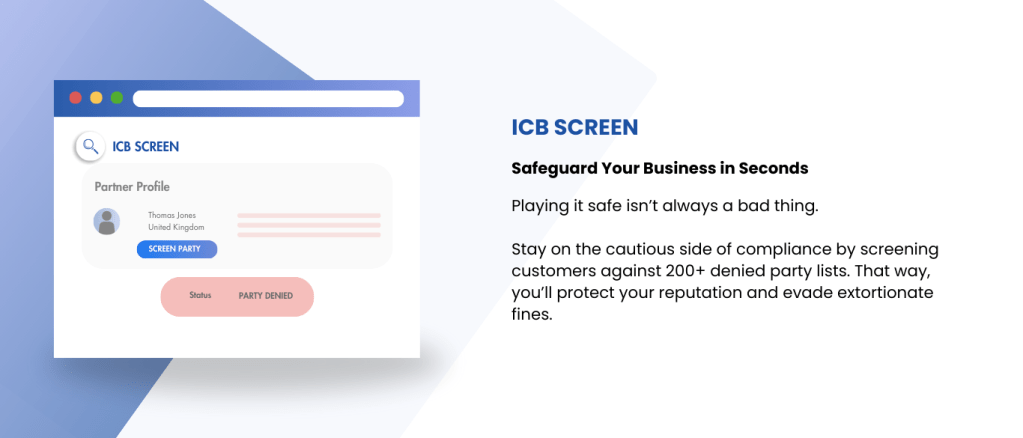

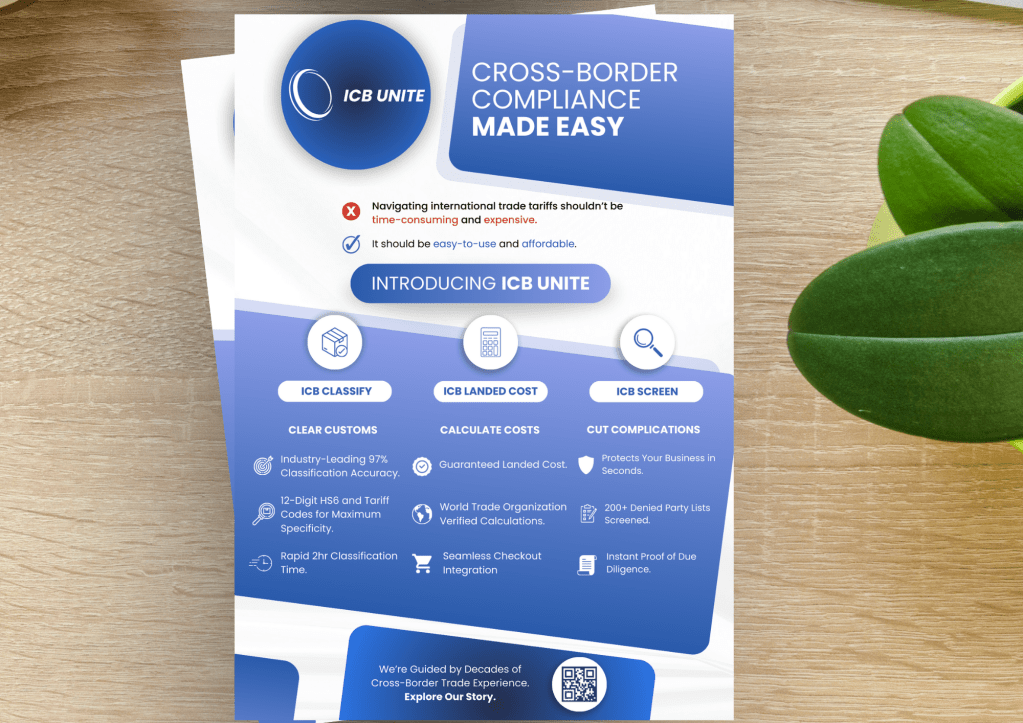

The product is made up of three features. The first helps businesses classify their goods with HS6 and tariff codes. The second provides an accurate landed cost in customers’ checkout. The third screens customers against denied party lists.

To sell the product, I knew I needed to create a brand that exuded trust.

THE IDEA:

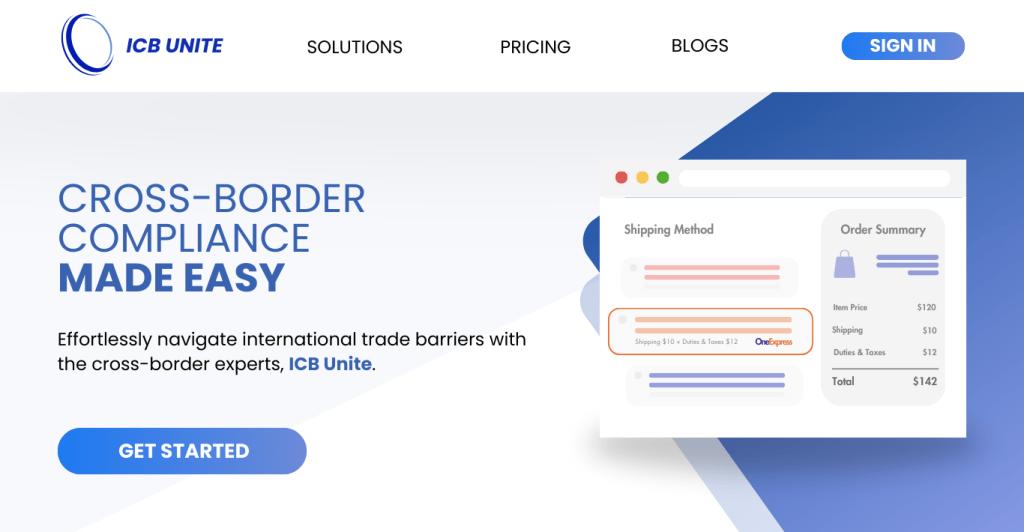

Starting with the product’s name, I wanted to convey the product’s direct link to international trade. So, ‘ICB (International Cross-Border) Unite’ was born.

Next, the product’s tagline ‘Cross-Border Compliance Made Easy’ succinctly communicates the product’s value proposition in a short, memorable statement that tackles a major pain point.

Each feature, a subsect of the product, was aptly named ‘ICB Classify’, ‘ICB Landed Cost, and ‘ICB Screen’ to quickly demonstrate what they do. Nice and simple.

As mentioned above, my time at the startup also helped me understand that business owners banking their business on a piece of software need to trust that it can be relied upon. There should be no frills, no extravagance and most importantly, no doubts about the product.

Accordingly, my tone of voice and copywriting style is direct and benefit-heavy.

For the design language, I opted for a warm-blue colour scheme to instil a sense of security and reliability within the product.

Here’s how it all came together:

WEBSITE LANDING PAGE

PRINT – FLYER

ONLINE / TV ADVERTS

Advert 1 | Product Teaser

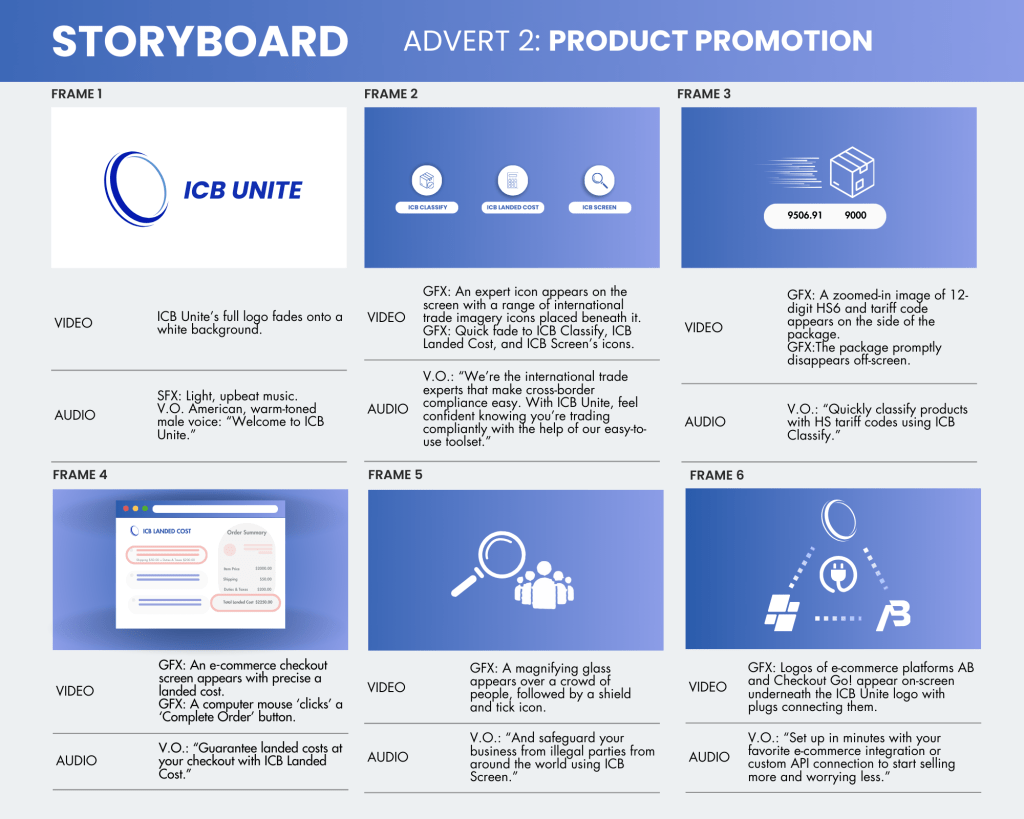

Advert 2 | Product Promotion

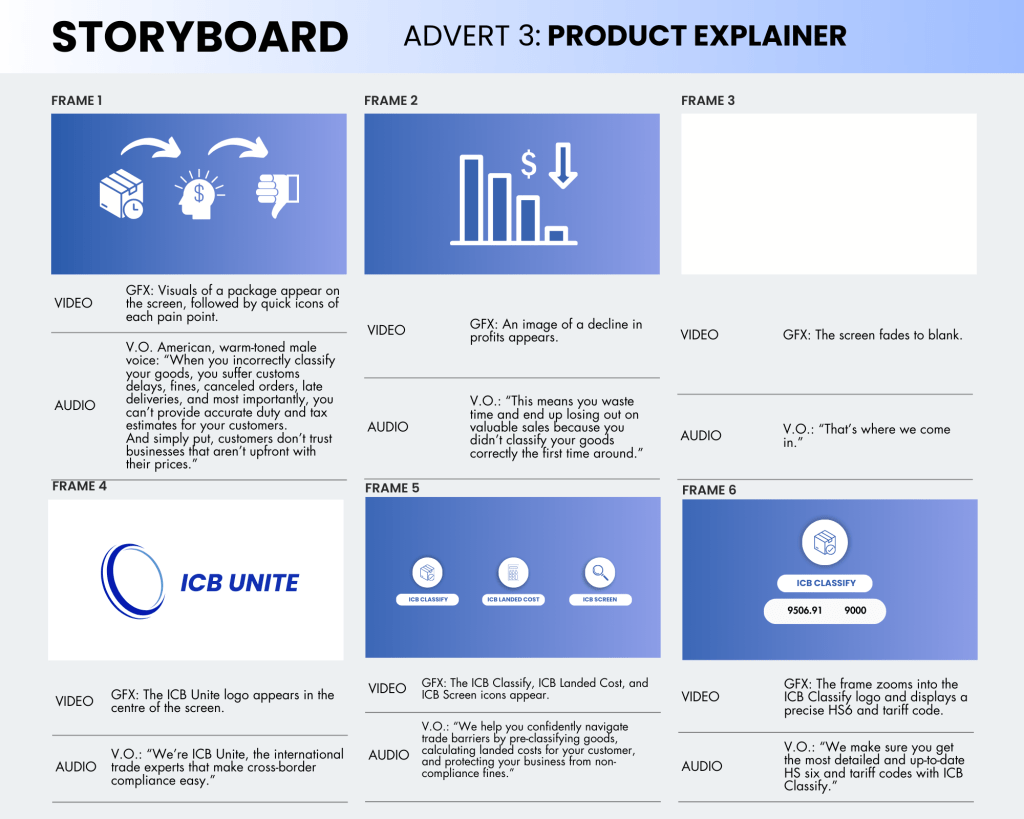

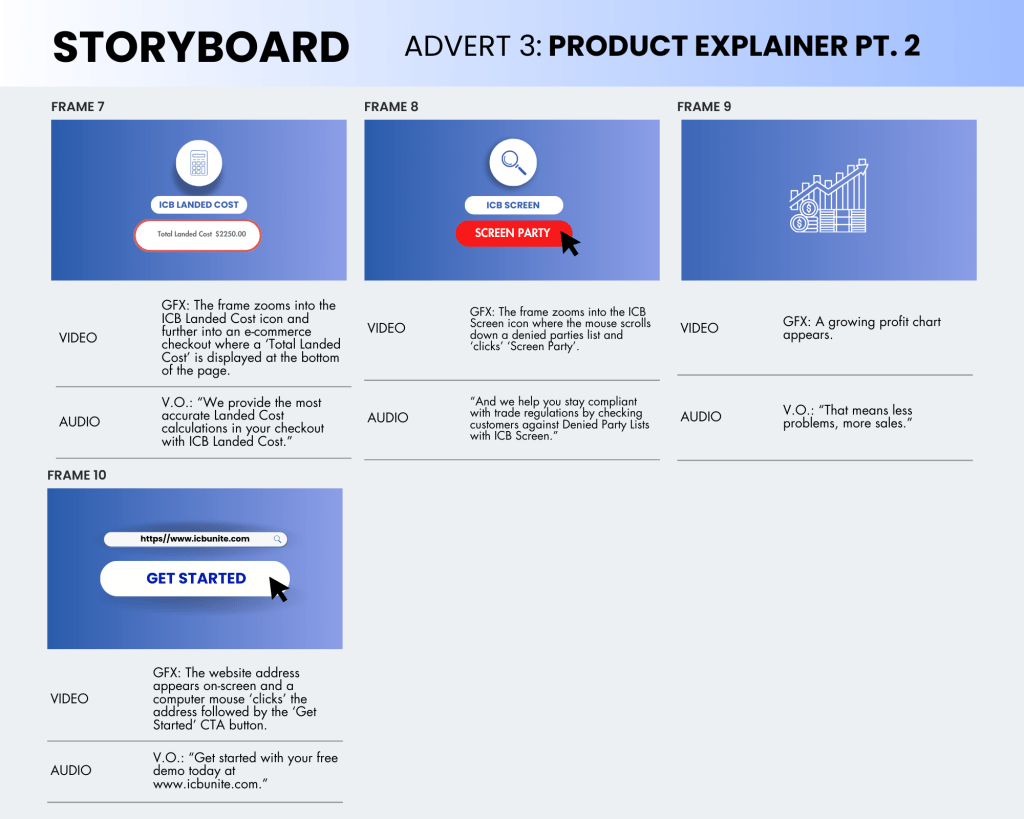

Advert 3 | Product Explainer

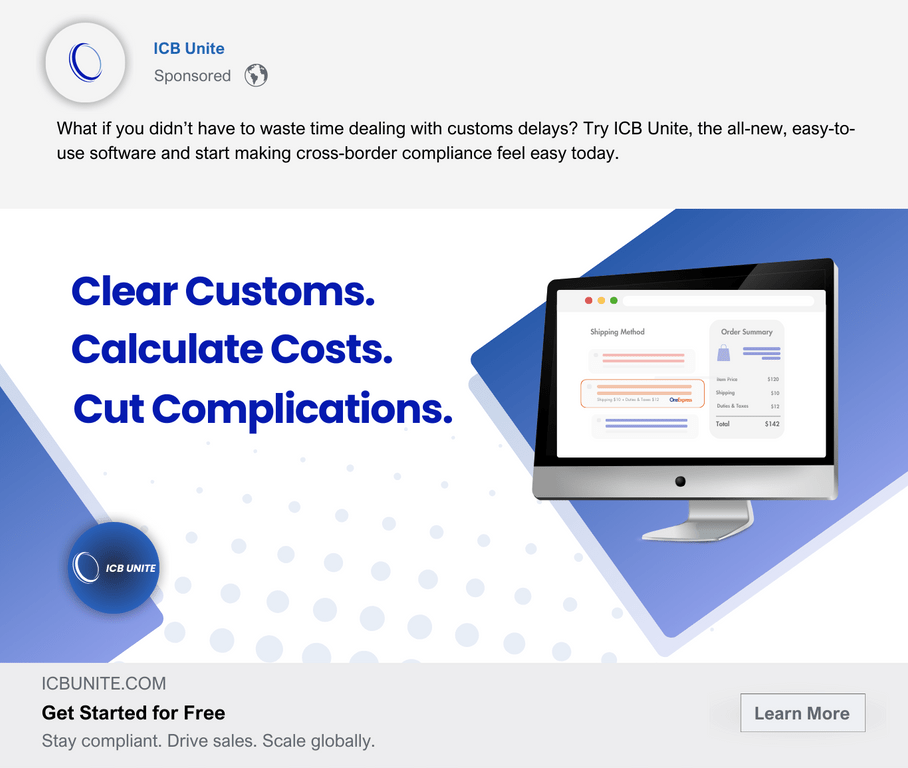

SOCIAL MEDIA ADVERT | FACEBOOK

CONTENT MARKETING COLLATERAL | BLOG

The Complete Guide to Denied Party Screenings

What similarities do airport security and international shipping compliance share?

Well, just as airport security checks passengers’ identities against watchlists to stop illegal individuals from boarding flights, international businesses must check if they’re working with illegal partners.

That’s what a Denied Party Screening is for.

A Denied Party Screening is an affordable compliance tool that helps safeguard your business from fines and legal penalties.

This blog is your complete guide to Denied Party Screenings.

Keep reading to learn everything you need to know about Denied Party Screenings, from why they’re important, to how often you should use them, to where you can find a reliable software solution.

Table of Contents:

- What is a Denied Party Screening?

- Denied Party vs. Restricted Party Screening: Are They the Same Thing?

- Five Reasons Why Your Business Needs to Undertake a Denied Party Screening

- Who Should You Screen?

- How Often Should You Screen Business Partners?

- What Lists Should You Check Business Partners Against?

- Six Quick Tips for Screening Partners

- Where To Find a Reliable Denied Party Screening Software

What is a Denied Party Screening?

Let’s start by asking: ‘What is a Denied Party Screening?’

Simply put, a Denied Party Screening is a protective measure used by businesses to check the legal eligibility of potential customers and business partners against official international watch lists.

These watch lists, which are commonly known as Denied Party lists, are comprised of people and businesses the government or international community has assessed to be high-risk or illegal to trade with.

High-risk or illegal parties include terrorists, weapons providers, or nation-states that have been internationally sanctioned.

So, now we’ve established what a Denied Party Screening is, let’s explore whether a Denied Party Screening is the same thing as a Restricted Party Screening.

Denied Party vs. Restricted Party Screening: Are They the Same Thing?

Now, if you’ve traded as long as we have, you’ve probably heard the term Restricted Party Screenings which will have you wondering ‘Is it the same thing as a Denied Party Screening?’

Not quite.

Whilst the pair essentially provide the same service of screening business partners against watch lists, there are a couple of minor differences between the two:

Denied parties are individuals, organizations, and entities explicitly barred from engaging in trade or business activities.

On the other hand, restricted parties encompass a broader category, which includes denied parties as well as individuals and entities facing fewer restrictions.

Restricted parties, for example, might still be permitted to do business under specific circumstances, whereas denied parties are banned from any type of trade.

Using either type of screening is essential for businesses – let’s explore why.

Five Reasons Why Your Business Needs to Undertake a Denied Party Screening

Non-compliance with international trade regulations can harm you in a range of ways. Here are five you can’t ignore:

1. Legal Sanctions

Simply put, failure to screen your customers means you’re not trading compliantly – and non-compliance can result in litigation from governments.

Depending on the severity, anyone found guilty of actively doing business with denied parties can face jail time of up to 20 years.

2. Financial Penalties

In numerous cases, fines are also imposed as part of any legal punishment.

For example, in 2012, HSBC was fined $1.9 billion after being found guilty of violating U.S. sanctions laws and conducting business with illegal parties in Iran, Sudan, and Libya.

Now, this might be an extreme case, however, HSBC’s penalty highlights the extortionate consequence of dealing with denied parties.

As general guidance, the Bureau of Industry and Security (BIS) also warns that businesses trading with denied parties can suffer fines of up to $1 million, administrative fees of up to $300,000, or penalties up to twice the value of a transaction.

3. Removal of Export Privileges

Export privileges can also be suspended or completely revoked by governments if a business is found guilty of violating compliance regulations.

Let’s take a quick look at the case of Florida company MIC P&I, LLC, Russian airline Smartavia, and freight forwarder Intermodal Maldives.

In May 2023, the BIS suspended their export licenses for intentionally diverting aircraft parts into Russia.

Make life easier. Only deal with legally approved partners.

4. Loss of Business Opportunity

Let’s quickly explore the recent “Huawei ban”.

Back in 2019, the U.S. government was concerned by the impact of Chinese communications company Huawei on national security, which forced them to impose major sanctions on the company.

Consequently, Google revoked Huawei’s Android license outside of China.

What this tells us is that non-compliance with trade regulations can seriously hamper your ability to do business with major partners – and unlike Huawei, similar bans won’t hurt you, they’ll finish you.

5. Reputational Damage

Much like fellow British bank HSBC, Standard Chartered was fined $227 million by U.S. authorities for violating sanctions against Iran, Sudan, Libya, and Myanmar.

As you might expect, the case tarnished the bank’s reputation as a respectable and trustworthy institution.

It took multiple public apologies, leadership changes, commitment to compliance programs, and cooperation with external regulators for the bank to escape with its reputation intact.

Most businesses and institutions don’t have the same luxury.

So, now you understand why it’s vital to screen parties, let’s explore who you should screen before you trade internationally.

Who Should You Screen?

As standard practice, we advise you to screen every one of your business partners. These include, but aren’t limited to:

- Customers

- Vendors

- Suppliers

- Resellers

- Freight Forwarders

- Customs Brokers

- Banks & Financial Institutions

Screen each of the above and you should have nothing to worry about.

Now, let’s quickly assess how often you should screen business partners.

How Often Should You Screen Business Partners?

As a company, we urge you to screen partners before every new transaction. It’s also wise to screen customers on a high-risk vs. low-risk basis.

High-risk deals are any that involve significant sums of money, sensitive goods, or any new customers, for example. These parties should be screened more frequently – potentially daily.

On the other hand, low-risk deals involve less money and long-term partners you trust. You could screen these weekly, monthly, or quarterly, for example.

As we say at ICB Unite, ‘It’s better to stay on the cautious side of compliance’.

So, now you’ve learned how often you should screen parties, you’re likely wondering ‘What lists should I check partners against, and where can I find them?’

What Lists Should You Check Partners Against?

It’s worth noting there are over 140 Denied Party lists used in the U.S. alone.

However, here are the major lists you should check your partners against:

- The Department of Commerce Bureau of Industry & Security’s (BIS) Entity List, Denied Persons List, and Unverified List.

- The Department of State’s (DOS) Designated Terrorist Organizations list.

- The Department of the Treasury’s Office of Foreign Assets Control’s (OFAC) list of Specially Designated Nationals and Blocked Persons (SDN).

- The United Nations Security Council’s (UNSC) Consolidated Sanctions List.

- The European Union’s Consolidated Sanctions List.

- The World Bank’s Debarred Entities List.

It might seem like a tedious task to screen customers against each of these lists, however, not doing so and being found guilty of dealing with denied parties isn’t worth the hassle.

However, there are numerous ways to make this process easier.

Six Quick Tips for Screening Partners

Now we’ve examined the main aspects of Denied Party Screenings, let’s dive into six quick tips that will help you screen parties as quickly and effectively as possible:

1. Screen Parties Regularly

As we mentioned above, you need to screen parties before every new transaction.

It’s also wise to screen parties based on a high-risk vs. low-risk basis.

2. Screening Names Alone is Not Enough

Screen beyond names.

Multiple people have the same name, so it’s easy for denied parties to hide their identities.

Make sure you screen names, addresses, Tax ID numbers, official IDs, and dates of birth.

That way, you’ll prove your vigilance.

3. Double-Check ‘Hits’

If you identify a denied party during a screening, this is known as a ‘hit’.

However, this hit could be a false positive.

So, check them – and check them again for good measure. Review their IDs and addresses etc. just to be sure.

If it is a genuine hit, you can cancel your order knowing you’ve been diligent.

4. Create a Response Protocol

If ‘hits’ do continue to occur, you’ll want to create an appropriate response protocol so that you and your team know how to calmly resolve any issues.

This could be a fixed investigation procedure, for example.

This makes it easy for you to know you’re mitigating the risks of denied parties logically and professionally.

5. Keep Records

Organize your paperwork.

Maintain a centralized database of your screening activities and outcomes, so you can prove to compliance officials you’re trading legally.

6. Use a Denied Party Screening Software

Manually screening business partners against Denied Party lists can feel like an impossible job.

It isn’t.

Improve Your Cross-Border Compliance With ICB Unite’s Denied Party Screening

To trade compliantly, you need to undertake a Denied Party Screening. Using a Denied Party Screening software protects you from legal sanctions, fines, and a loss of business opportunities.

With ICB Unite, you can screen business partners against over 150 Denied Party lists in minutes to prove your compliance when you trade internationally.

Why not get started with a free demo and discover how we’re helping thousands of businesses across the world trade compliantly?

FREQUENTLY ASKED QUESTIONS (FAQs)

- What is a Denied Party Screening?

A Denied Party Screening is a protective measure businesses use to verify the legal eligibility of customers and business partners against official international watch lists, known as Denied Party lists. - What’s the Difference Between Denied Party Screenings and Restricted Party Screenings?

Denied Party Screenings and Restricted Party Screenings essentially serve the same purpose of screening business partners against watch lists.

However, denied parties are explicitly barred from engaging in trade or business activities, while restricted parties encompass a wider group, and are subject to fewer restrictions. - Why Do I Need to Undertake a Denied Party Screening?

Undertaking a Denied Party Screening is crucial to avoid legal sanctions, financial penalties, removal of export privileges, loss of business opportunities, and reputational damage relating to non-compliance. - Who Should I Screen Before Trading Internationally?

We recommend you screen all business partners, including customers, vendors, suppliers, resellers, freight forwarders, customs brokers, banks, and financial institutions, before every international trade transaction. - How Often Do I Need To Screen Business Partners?

Business partners should be screened before every new transaction.

The frequency of screening also varies based on the risk level of the deal, with high-risk deals requiring more frequent screening, potentially daily, and low-risk deals needing screening on a weekly, monthly, or quarterly basis.